The world’s leading Tech companies are dramatically ramping up their investments in artificial intelligence as they race to capture the rewards of an AI-driven boom that has pushed global markets to record levels. Recent earnings reports from Meta, Alphabet, and Microsoft revealed the enormous scale of spending being poured into AI, from data centers and chip infrastructure to software development and cloud innovation. Despite lingering questions about when these massive outlays will deliver measurable returns, the enthusiasm from investors and executives remains strong.

Meta announced that its capital expenditures for 2025 are expected to range between $70 billion and $72 billion, an increase from earlier projections of $66 billion to $72 billion. The company also indicated that its spending for 2026 will be significantly higher, highlighting its commitment to competing with other leading players in the AI field, including OpenAI. Chief executive Mark Zuckerberg emphasized during an analyst call that accelerating investment is the right strategic move for Meta. He pointed out that AI offers immense potential, both for creating new products and optimizing the company’s existing business model centered on advertising and content distribution.

Tech Giants Boost AI Investments Amid Soaring Market and Fierce Competition

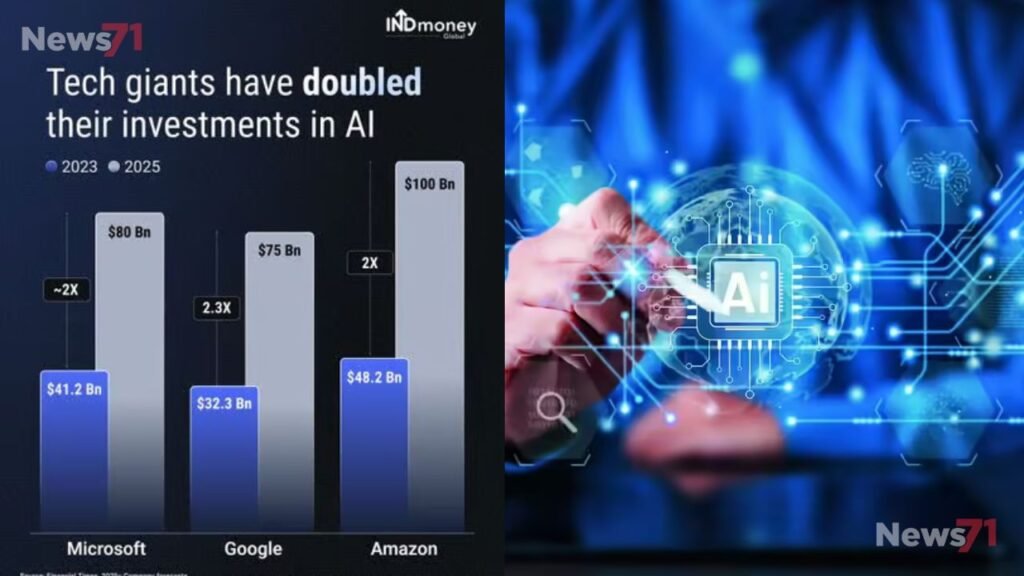

Alphabet, the parent company of Google and YouTube, also raised its capital expenditure forecast for this year to a range between $91 billion and $93 billion, up sharply from its earlier estimate of $85 billion during the summer. That projection nearly doubles what the company spent in 2024, reflecting its ambition to expand its dominance in the Tech and AI markets. Meanwhile, Microsoft reported capital expenditures of $34.9 billion in the quarter ending 30 September, primarily allocated to data centers and infrastructure supporting its AI services. This figure exceeded analysts’ expectations and represented a steep jump from $24 billion in the previous quarter.

MOST READ: Dutch Election Too Close to Call as Wilders Surges in Polls

Chief executive Satya Nadella stated that Microsoft continues to expand its investments in both AI technology and human talent to capitalize on the enormous opportunities ahead. He noted that the company’s cloud platform, Azure, and its growing suite of AI-powered tools are already having a significant real-world impact across industries. The surge in AI investment has fueled investor confidence, helping Meta, Alphabet, and Microsoft outperform the broader S&P 500 index in recent months. However, analysts remain watchful to see if these heavy expenditures will soon translate into tangible business results. According to Aditya Bhave, senior US economist at Bank of America, the US economy’s recent resilience has been largely supported by consumer spending and corporate investment in AI. He suggested that continued strength in AI-related Tech spending would be a positive indicator for economic growth. Meta’s latest earnings showed a rise in quarterly revenue but a steep drop in profit down 83 percent year over year to $2.7 billion—due to a one-time tax expense. In contrast, Microsoft’s profits climbed 12 percent to $27.7 billion, while Alphabet reported a 33 percent increase, reaching approximately $35 billion.

Source: BBC