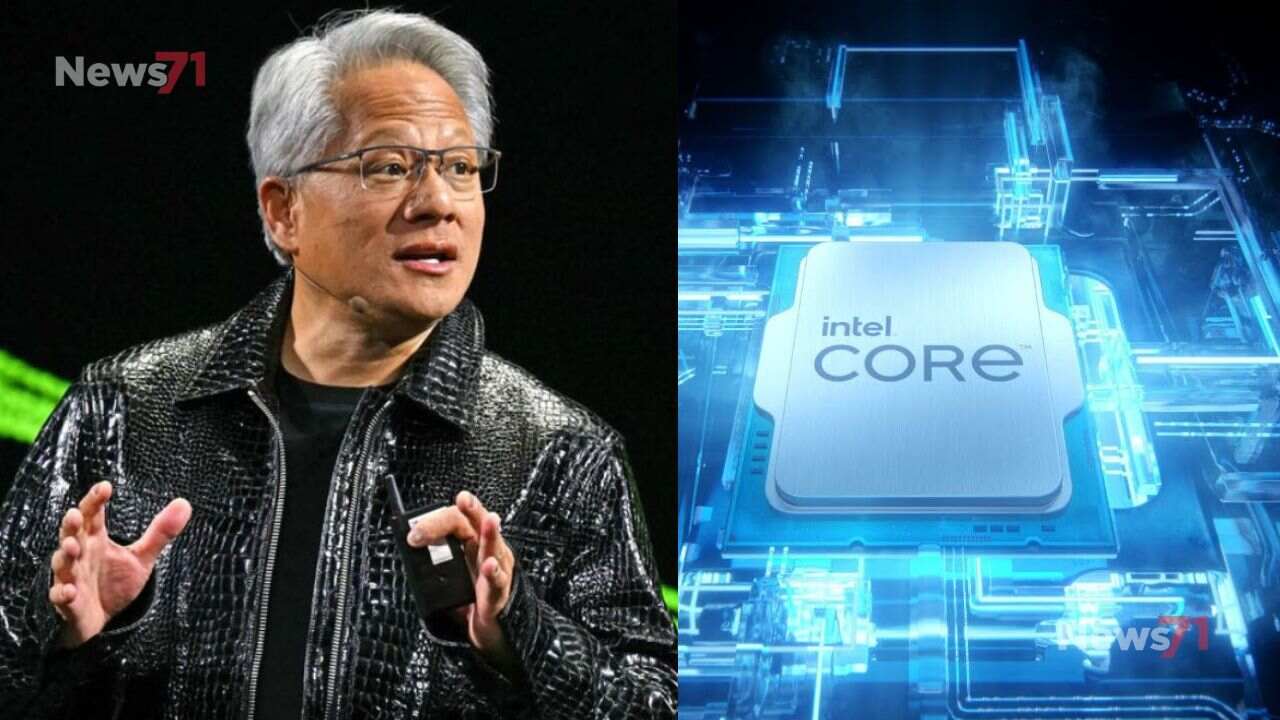

Nvidia Commits $5bn to Intel After Trump Administration’s 10% Stake

Nvidia commits $5bn to Intel in a landmark investment that signals one of the most significant collaborations in the history of the semiconductor industry. The world’s leading chipmaker announced the deal just weeks after the Trump administration revealed its extraordinary decision to acquire a 10% stake in Intel, underscoring Washington’s growing intervention in critical technology sectors.

Nvidia and Intel Join Forces

Nvidia confirmed it will invest $5bn to purchase Intel common stock at $23.28 a share, pending regulatory approvals. Beyond the financial infusion, both companies will collaborate on developing next-generation products for artificial intelligence (AI) infrastructure and personal computers.

Nvidia CEO Jensen Huang described the partnership as “historic,” noting that it fuses Nvidia’s AI and accelerated computing platforms with Intel’s CPUs and the global x86 ecosystem. According to Huang, this alliance will not only strengthen both companies’ ecosystems but also “lay the foundation for the next era of computing.”

The announcement immediately boosted investor confidence. Shares in Intel surged by 27% during early New York trading, while Nvidia rose more than 3%, extending its market capitalization above $4 trillion.

Focus on AI and Data Centers

Under the agreement, Intel will manufacture custom chips tailored for Nvidia’s advanced AI infrastructure platforms, which power data centers worldwide. On the PC front, Intel will design processors integrated with Nvidia technology, offering a significant performance boost for consumer and enterprise computing. Nvidia commits $5bn

This collaboration directly targets the explosive growth in AI computing. Nvidia’s GPUs have become the backbone of AI development, making the company indispensable to governments, corporations, and research institutions driving innovation in machine learning and automation.

A Lifeline for Intel

For Intel, the deal comes as a lifeline. Once a Silicon Valley pioneer that dominated the PC era, Intel has faced years of decline after missing the transition to mobile computing and struggling to compete in the AI-driven chip race. The company reported losses of nearly $19bn in the previous year and an additional $3.7bn in the first half of 2025. Intel is also preparing to cut around 25% of its workforce by the end of the year. This investment, coupled with a $2bn stake purchased earlier by Japan’s SoftBank, may provide the necessary resources and momentum for Intel to regain competitiveness in the AI market. Nvidia commits $5bn

Trump Administration’s Role

The backdrop to Nvidia’s announcement is the Trump administration’s growing involvement in America’s semiconductor industry. By taking a 10% stake in Intel, the White House has signaled its determination to secure domestic chipmaking and reduce reliance on foreign suppliers.

Trump has previously threatened to impose 100% tariffs on imported chips while negotiating export deals with Nvidia and AMD. These agreements allowed US companies to sell certain AI chips to China with reduced power capabilities, in exchange for a 15% cut of sales revenues.

Such interventions highlight the geopolitical importance of semiconductors, particularly as AI and high-performance computing become central to national security and economic competitiveness.

Industry Reactions

Industry analysts view the move as validation of Nvidia’s dominance. Dan Ives of Wedbush Securities emphasized that AI infrastructure spending is expected to reach between $3 trillion and $4 trillion by the end of the decade. According to Ives, “the chip landscape remains Nvidia’s world, with everyone else paying rent.”

With Nvidia commits $5bn making headlines, experts believe this partnership could reshape the semiconductor landscape. For Intel, it may mark the beginning of a long-awaited comeback, while for Nvidia, it cements its role as the undisputed leader in the AI revolution.